Dholera SIR Price Evolution: The Real Growth Pattern Behind Plot Rates

Table of Contents

- The Greenfield Vision Behind Dholera Smart City

- Early Market Phase and Initial Plot Pricing

- Planning Approvals and the Rise of the Activation Area

- Infrastructure Execution and Real Price Appreciation

- Connectivity as a Growth Catalyst

- Industrial Growth and the Semiconductor Ecosystem

- Dholera SIR Current Status 2025

- What This Price Evolution Means for Today’s Buyers

- Conclusion

Dholera Smart City is one of India’s largest greenfield urban projects, planned from scratch and executed in phases. And that is exactly why Dholera plot prices have not moved randomly. Over the years, pricing has followed a visible pattern, first driven by planning clarity, then by on ground infrastructure, and now by readiness for large scale usage. This blog explains when rates moved, why they moved, and what that means if you are exploring plots today.

The Greenfield Vision Behind Dholera Smart City

A greenfield development means a city is built on previously undeveloped land, instead of expanding an existing urban area. Dholera SIR was notified in 2009 as part of the Delhi Mumbai Industrial Corridor, with the goal of developing a fully planned smart city with defined industrial, residential, and commercial zones.

What made Dholera different was the approach. The planning framework was designed first: land use zoning, sector planning, utility corridors, and development standards. The intent was to build a plug and play environment where industries and communities could function with ready basics like roads, water supply, wastewater systems, power infrastructure, and core administrative support.

Early Market Phase and Initial Plot Pricing

Before 2017, plot rates in many pockets remained low, often around ₹1,000 to ₹1,500 per square yard. At that stage, the area had limited connectivity, fewer usable internal roads, and the perception gap was wide. The Ahmedabad to Dholera distance felt longer because the travel experience was still not smooth.

Most early buyers were either locals or long term buyers who were comfortable holding patiently while planning translated into execution. For mainstream buyers, the question was simple: will this vision become usable on the ground, and when.

Planning Approvals and the Rise of the Activation Area

The first meaningful price shift did not come from big announcements. It came from clarity.

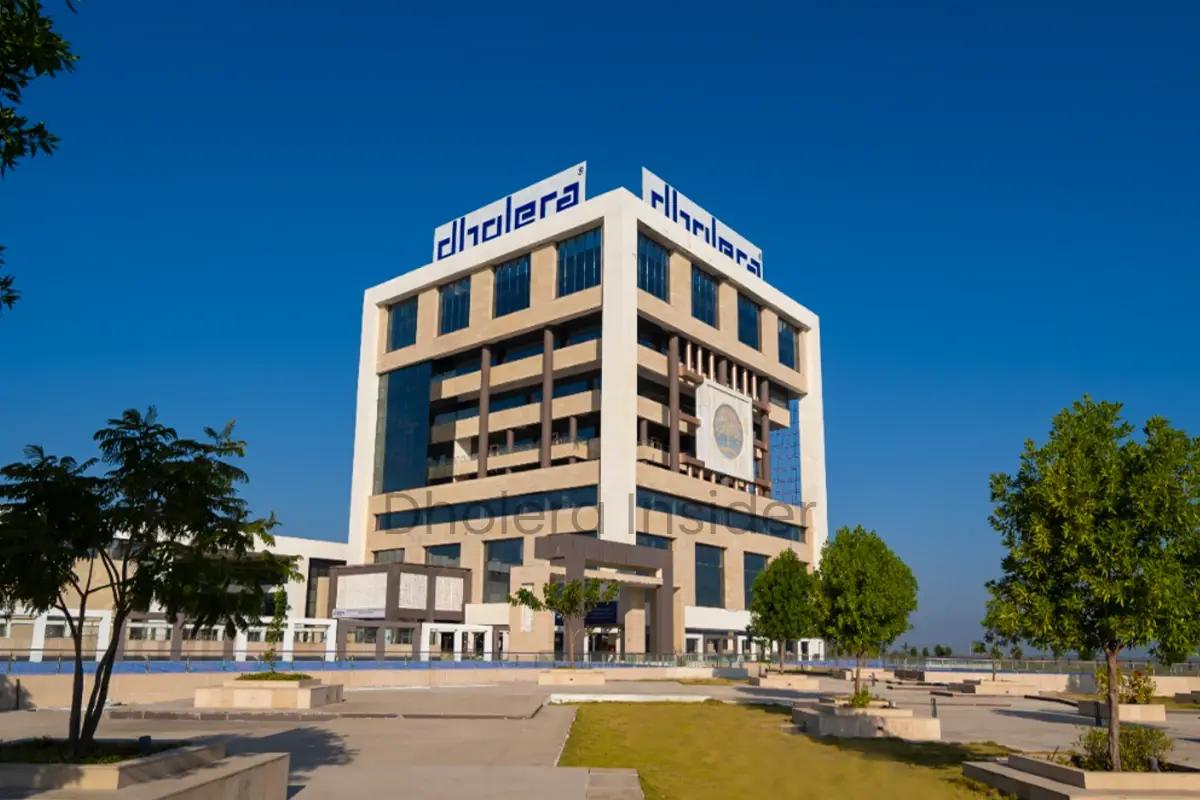

As town planning progressed and execution concentrated inside the Activation Area, market confidence improved because the project was no longer spread thin. The Activation Area is around 22.5 square kilometers and was positioned as the first zone to receive complete trunk infrastructure. Key trunk components listed for the Activation Area include 72 km roads and utility services, potable water supply networks, wastewater treatment planning, power infrastructure, ICT coverage, and the ABCD building.

By 2017 and 2018, plots in planned zones were being quoted closer to ₹2,500 to ₹3,000 per square yard. This phase proved an important point: in planned cities, regulatory clarity itself creates an early growth cycle.

Infrastructure Execution and Real Price Appreciation

Between 2022 and 2024, Dholera’s progress became easier to see. The market response strengthened because the story shifted from planning to delivery, roads, utilities, and administrative systems moving closer to actual use.

Inside the Activation Area, trunk infrastructure coverage is defined around the basics that enable industries and townships to function, not just exist on paper. That includes major road networks with utility planning, water supply and wastewater treatment planning, ICT coverage, and power infrastructure.

On the energy side, renewable generation has already come online in the region. Tata Power Renewables commissioned a 1300 MW solar project at Dholera in April 2022.

This is also where the price pattern becomes clear: rates move strongest when infrastructure becomes usable, not when it is announced.

Connectivity as a Growth Catalyst

Among all milestones, connectivity tends to reshape buyer behaviour the fastest. As the Ahmedabad Dholera Expressway reached advanced completion stages and moved toward opening, travel time expectations tightened to roughly 40 to 45 minutes, which changes how buyers evaluate Dholera for residential and commercial use.

Better access brings more site visits, more real demand, and stronger pricing in pockets near key corridors and planned activity zones.

Industrial Growth and the Semiconductor Ecosystem

Industrial momentum matters because it creates the strongest kind of demand: demand backed by employment and daily movement.

Large manufacturing projects do not just bring factories. They bring housing needs, rental demand, service businesses, warehousing, logistics, and support offices. That is why the Tata semiconductor plant has become important for Dholera’s next phase, especially once activity moves from planning and development into steady operations.

Dholera SIR Current Status 2025

By 2025, the project narrative is increasingly about readiness and usage, not only construction. In the Activation Area, trunk infrastructure scope is clearly defined across roads, smart water systems, plug & play infrastructure, solar power, ICT coverage, and administrative support.

For the airport, public updates generally indicate ongoing construction activity across runway and terminal side development, but exact completion percentages vary widely by source. The Dholera International Airport work is progressing steadily and is being tracked as a key milestone for the next phase of demand.

This is also why pricing ranges have widened. Prime pockets near the corridor, planned activity zones, and future anchors often command a premium, while less connected locations lag.

What This Price Evolution Means for Today’s Buyers

If you are buying now, you are not buying at the “idea stage.” You are buying during a transition window, where infrastructure delivery is already visible and the next driver is large scale usage, jobs, commercial movement, and everyday activity.

Historically, the strongest price movement tends to show up after infrastructure becomes functional and occupancy starts like Tata Semiconductor fab, Ahmedabad Dholera Expressway, Dholera international Airport, and more . That is why the 2026 to 2030 period is widely watched, because it aligns with the expected impact window of airport linked movement and industrial scale operations.

The bigger decision for buyers today is not “will Dholera happen.” It is:

- Are you buying the right location inside the correct planning zone

- Is the title chain clean and registry ready

- Is the plot mapped correctly, not just described verbally

- Does access and surrounding development support real usability

Conclusion

Dholera plot price evolution shows a predictable sequence: planning clarity drives the first cycle, infrastructure delivery drives the second, and operational economic activity drives the strongest cycle.

As Dholera moves deeper into the usage phase, future price movement is more likely to be supported by real demand patterns, not speculation. Buyers who focus on verified documentation, correct zoning, and location logic will always be better positioned than buyers who chase only low quotes.